How to credit an invoice / create a credit note

For documentation purposes and legal reasons, you cannot delete an invoice. If you make a mistake when you create an invoice—or you agree with the customer that they don't have to pay the invoice—you have to create a credit note.

For documentation purposes and legal reasons, you cannot delete an invoice. If you make a mistake when you create an invoice—or you agree with the customer that they don’t have to pay the invoice—you have to create a credit note.

An invoice is a type of accounting documentation, and you’re not allowed to alter or delete it once it’s been created. A credit note is a counter-document, which cancels out the invoice. This is the only way to “delete” an invoice.

How to create a credit note

On the homepage, simply click on the invoice under the Follow up or Unpaid invoices-section or search for it in your invoice overview.

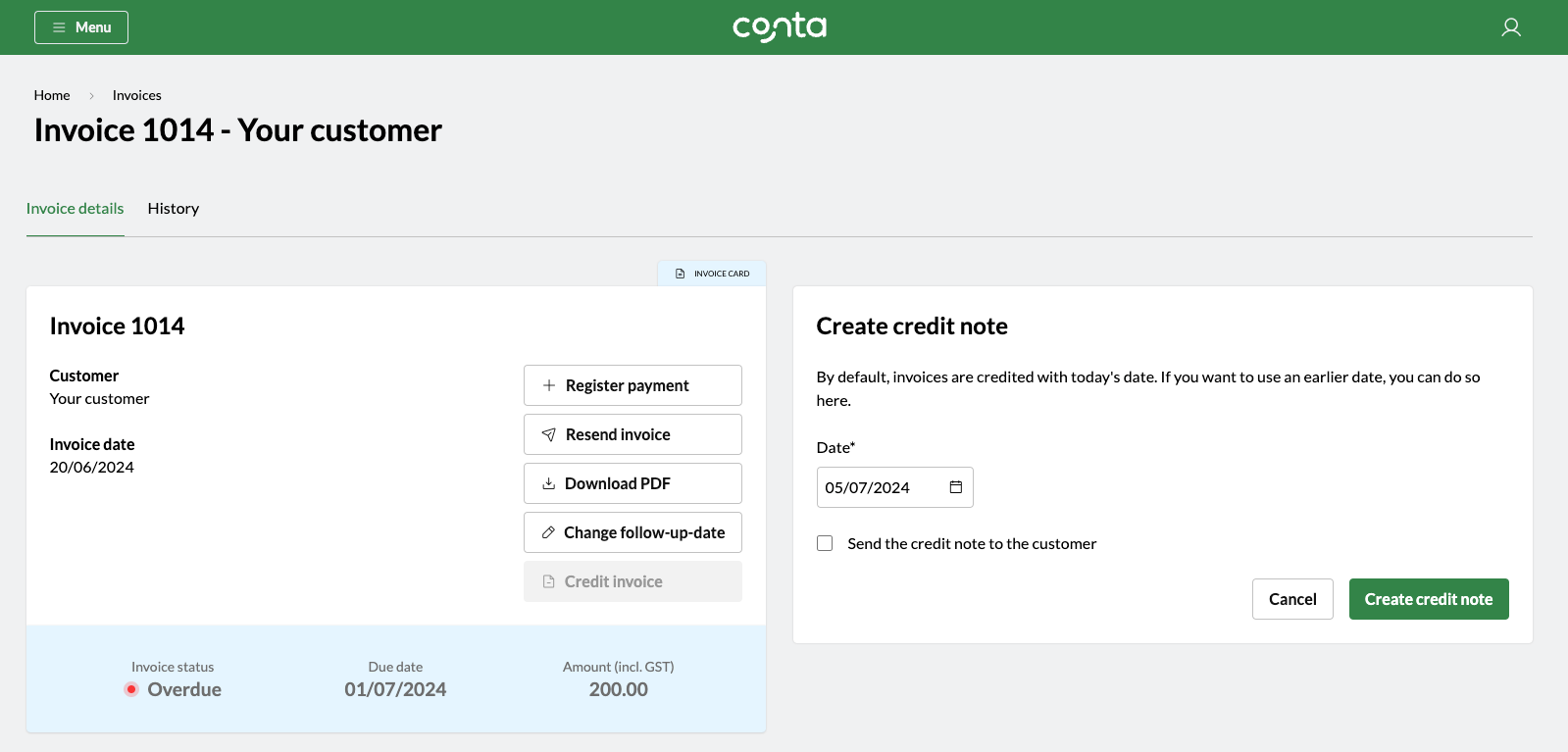

Click CREDIT INVOICE.

The credit note date will default to today’s date, but you can change this if you want.

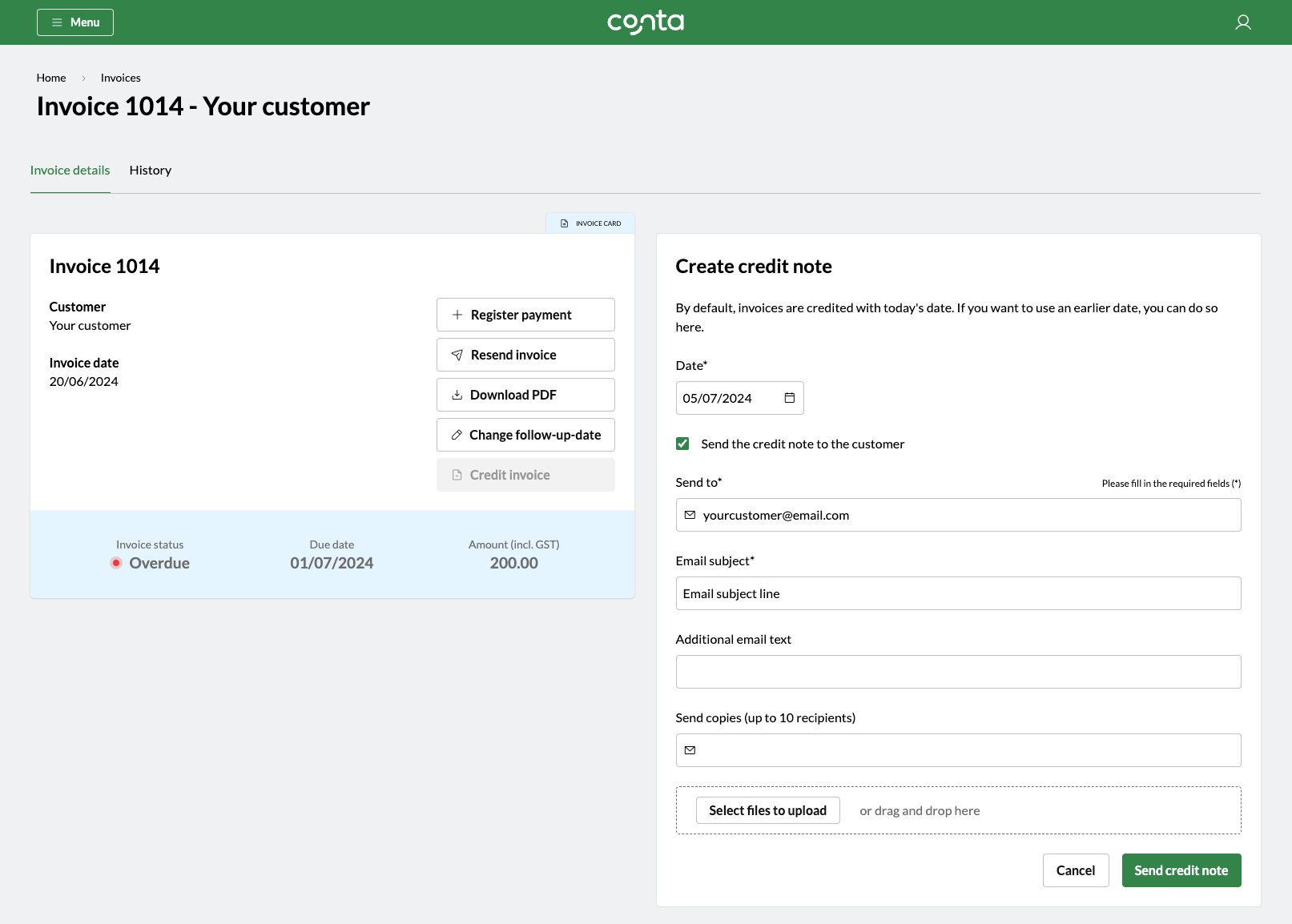

You can edit the recipient and the email subject line, and add additional email text before sending. You can also send copies to other recipients by entering their email in the Send copies-field. If you want to attach a file, you can also do that by clicking SELECT FILES TO UPLOAD or by dragging and dropping files.

Then simply click SEND CREDIT NOTE, and you’re done!

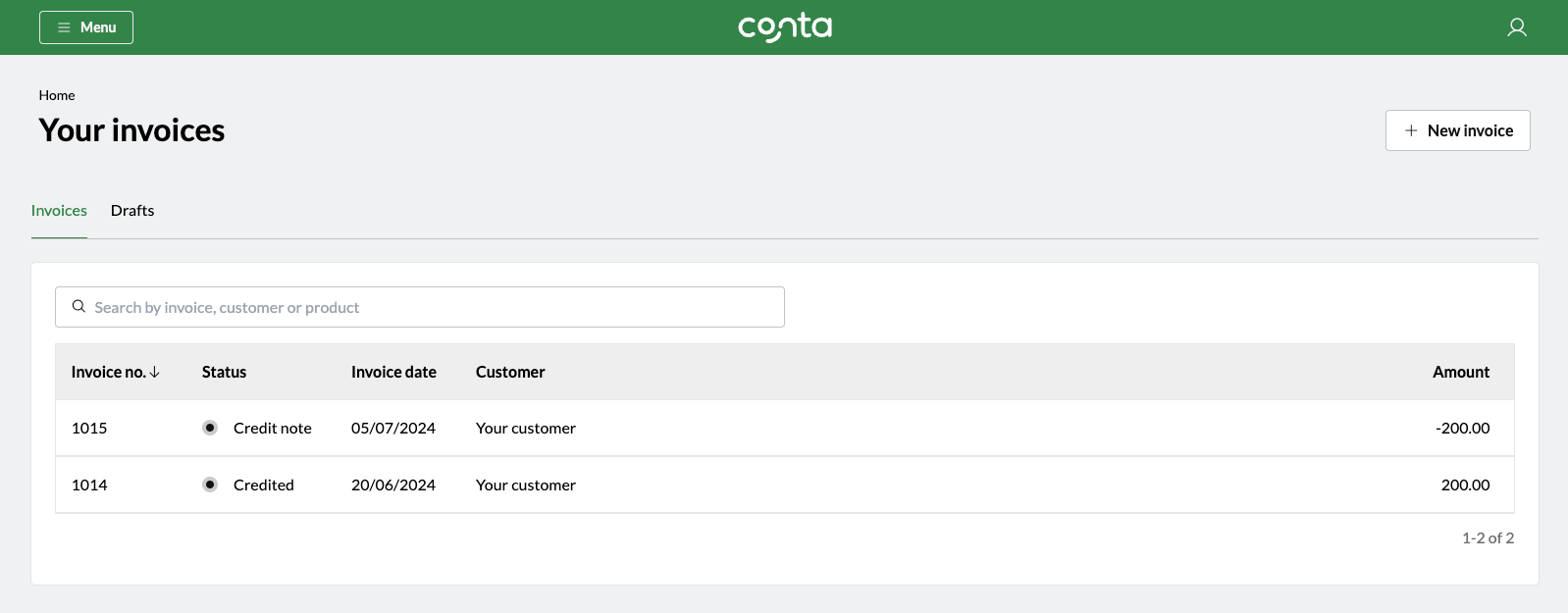

The invoice will be listed as credited, and you will find the credit note in your invoices list too:

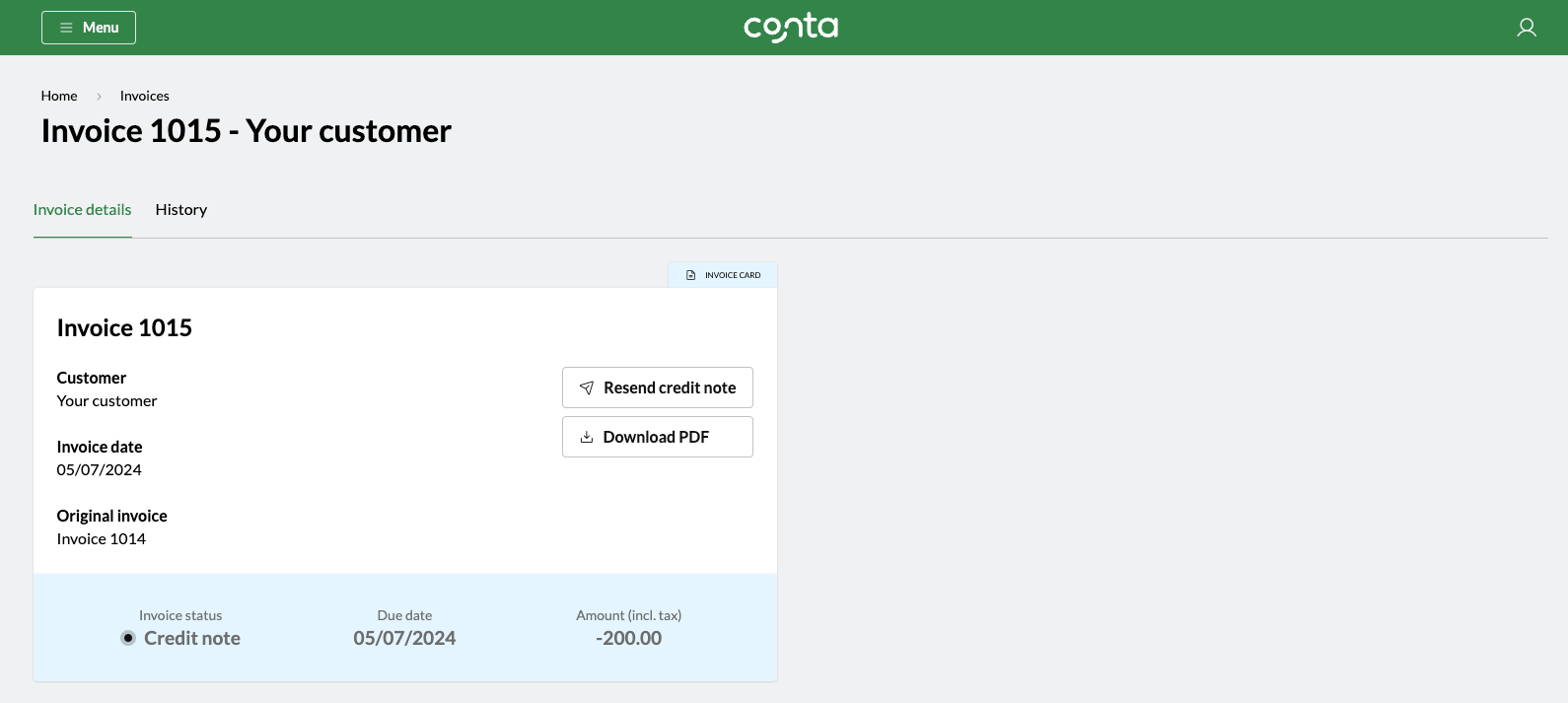

Click on the credit note to resend the credit note or to download a copy for your own records.

What if I never sent the credit note?

If you never sent the invoice to the customer—for example, if you noticed an error after you created it— you still need to create a credit not for your own bookkeeping. It will also remove the invoice from the list of unpaid invoices in Conta, and only show you the invoices you need to follow up on.

To create an invoice without sending it, simply deselect Send the credit note to the customer. You will then get the option to create the credit note.