Add your business

The first time you create an invoice in Conta, you'll be asked to add your business details. This information will appear on the invoices you create, and let your customer know who the invoices are coming from.

The first time you create an invoice in Conta, you’ll be asked to add your business details. This information will appear on the invoices you create, and let your customer know who the invoices are coming from.

Not ready to send an invoice yet? You can add your businesses to Conta now, so that you can send invoices easily in future.

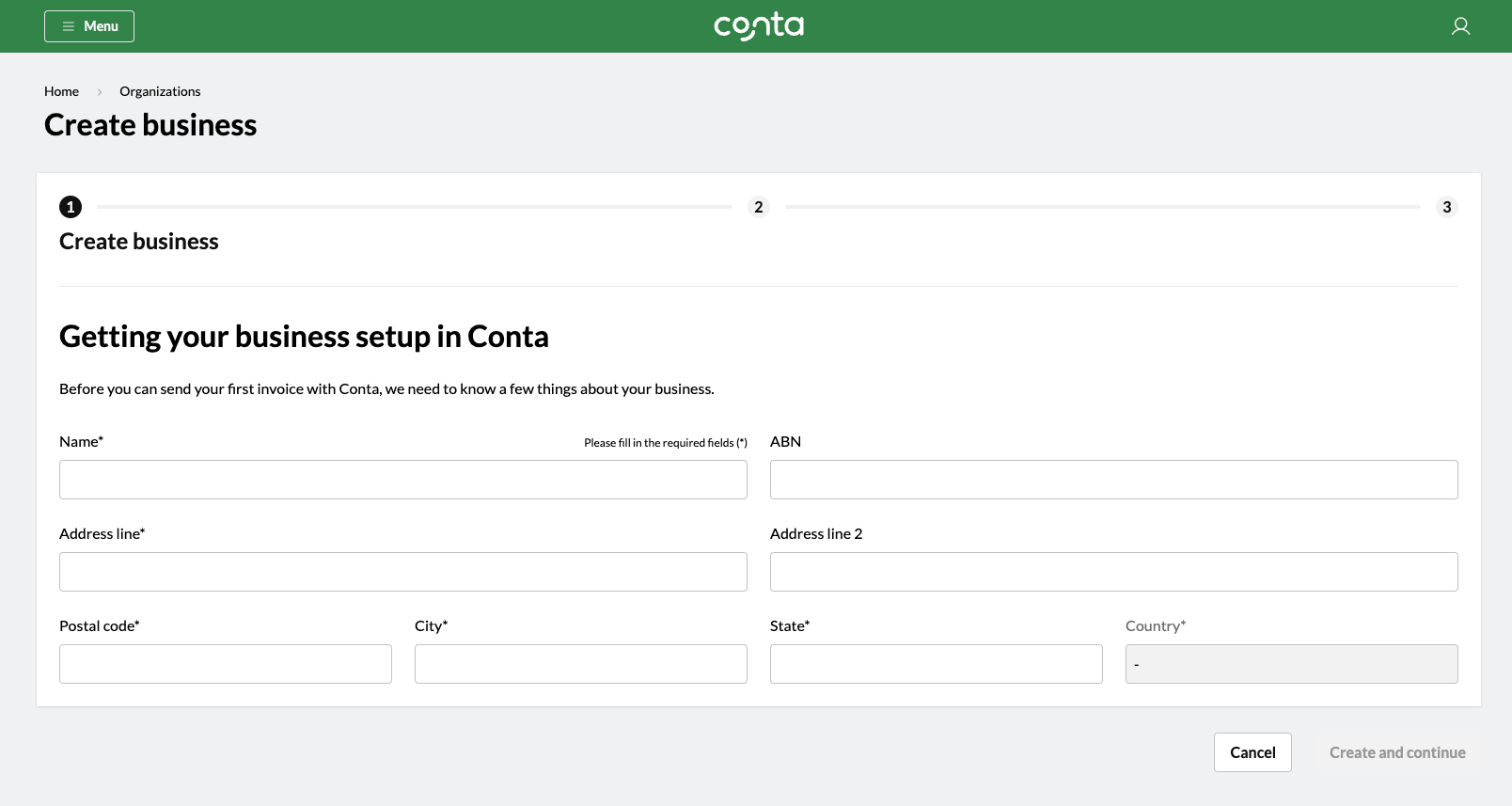

Go to the homepage, and click CREATE BUSINESS to add your business information.

How to add your business

First, you add your business name, organization number, if relevant, as well as the business address.

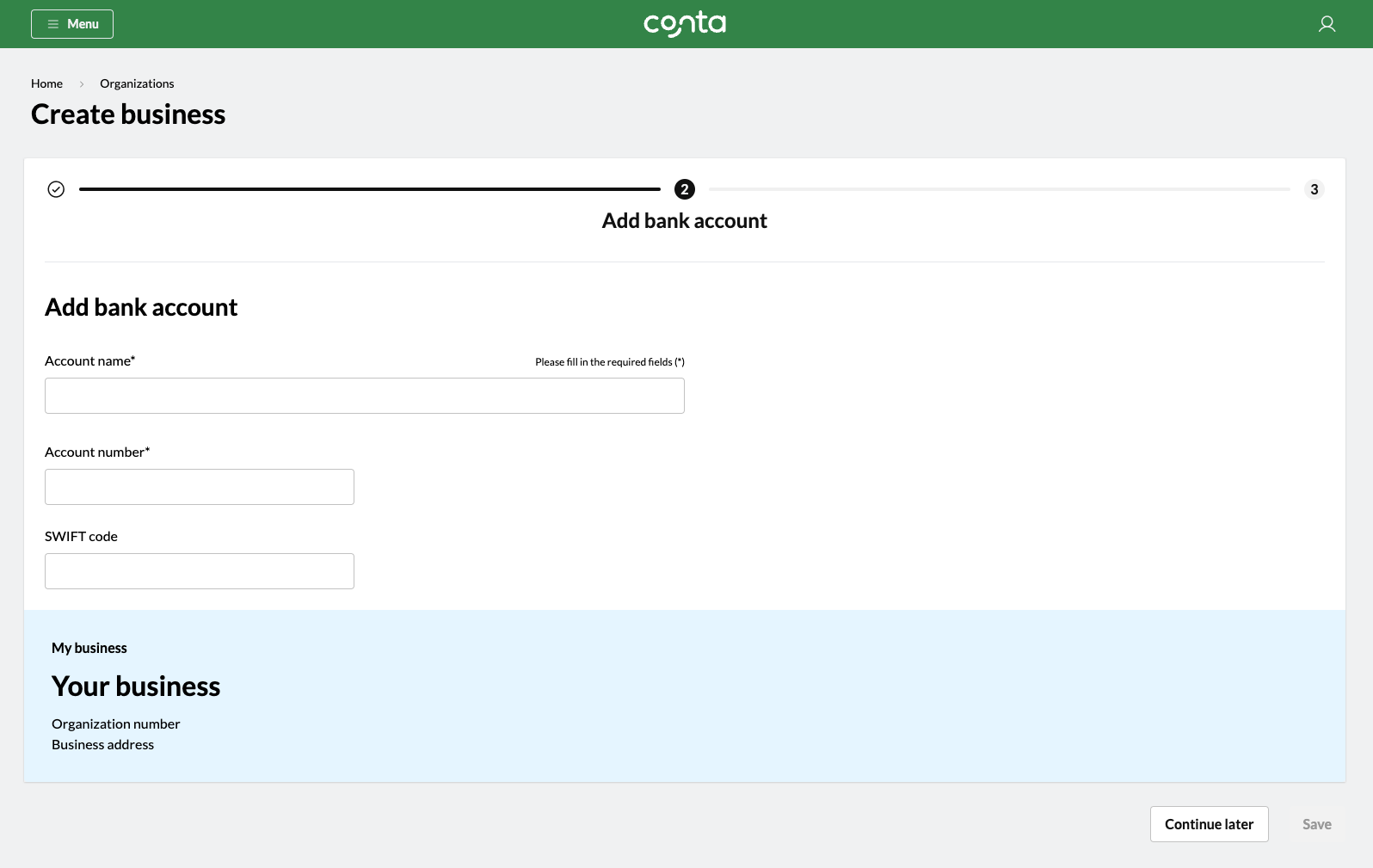

Then you add your payment details. This information will appear on your invoices and let your customers know how to pay you.

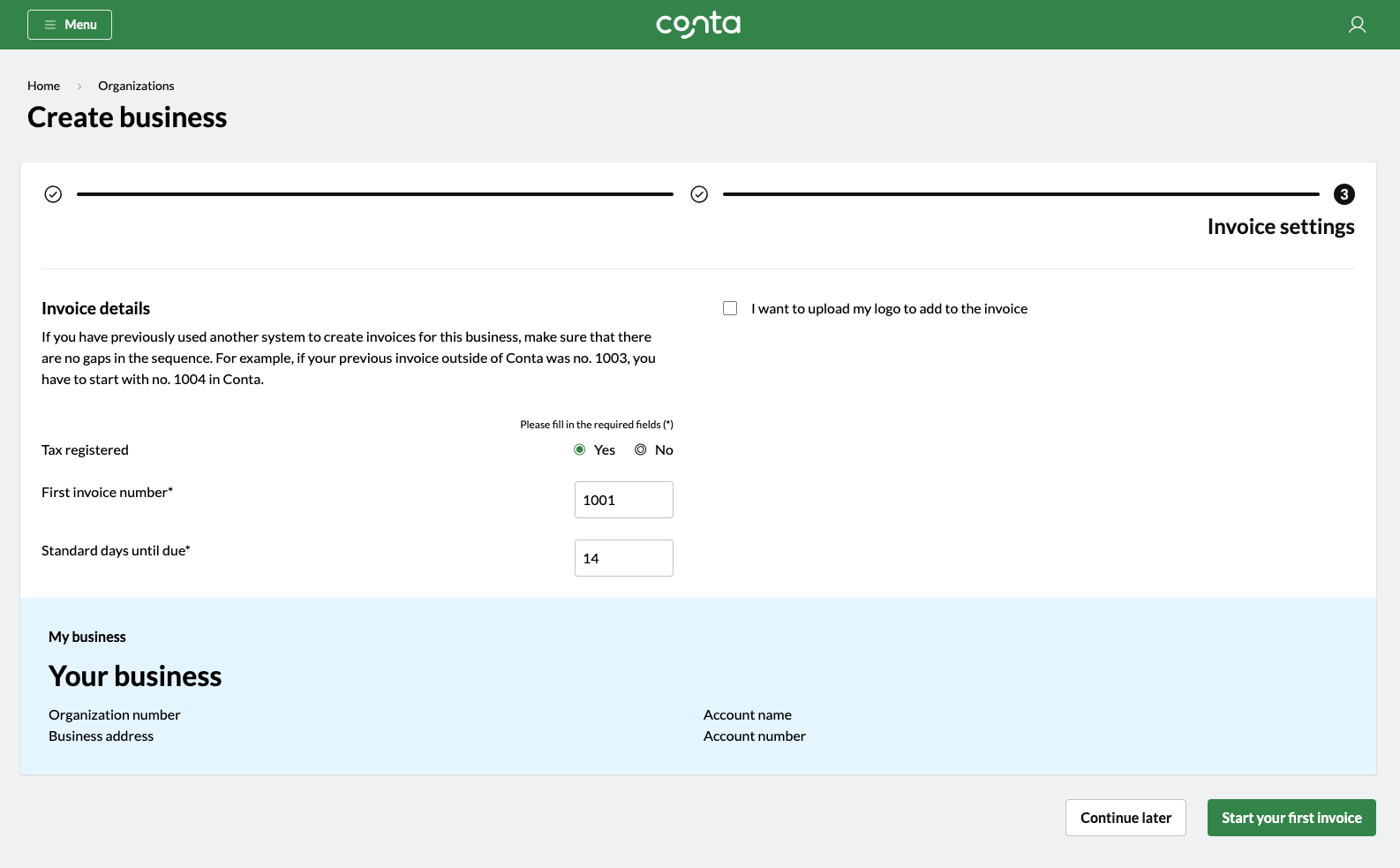

Lastly, you decide your invoice settings. If your company is tax registered, the invoices you create in Conta will be tax invoices by default; if your company is not tax registered, they’ll be regular invoices.

You also have to set a standard payment deadline.

Please note that you can edit both invoice type—tax invoice or regular invoice—as well as payment deadline when you create invoices.

If you have a business logo, you can upload it here. It will appear on your invoices.

What does invoice number mean?

By law, your invoices must be numbered and there cannot be any gaps in the sequence. Conta ensures you meet those requirements, but you have to set a starting number.

If you’ve not created any invoices from this business before, you can set the invoice number as 1, 1001 or whatever starting number you want. If you have created invoices from this business before, check the number on your last created invoice. Your first invoice number in Conta should be one higher. If your last invoice was 200, you should enter 201 in Conta.

Click SAVE and you’re all set!

Ready to send your first invoice? This is how you create an invoice in Conta.