How to cancel an invoice: Crediting or writing off

An invoice is a type of accounting documentation, and for legal reasons you can't delete an invoice. There are two ways to cancel an invoice: crediting the invoice or writing off the invoice.

An invoice is a type of accounting documentation, and for legal reasons you can’t delete an invoice. There are two ways to cancel an invoice: crediting the invoice or writing off the invoice.

When to credit the invoice

If you make a mistake when you create an invoice, you can credit the invoice. When you credit the invoice, you’ll get a credit note. This is a counter-document, which cancels out the invoice. If you’ve already sent the invoice to the client, you should send the credit note as well.

Then you can create a new invoice with the correct information on it.

See also: I’ve made an invoice mistake, what do I do?

When to write off the invoice

You can write off the invoice when you know it won’t be paid. If your client is unable or unwilling to pay, and you have exhausted your debt collection options, or you don’t want to spend time chasing the payment, you can write off the invoice.

There are usually certain criteria to meet before you can write off an invoice, for example that a certain amount of time having passed since the due date, and/or that you’ve sent x number of payment reminders.

How to credit the invoice

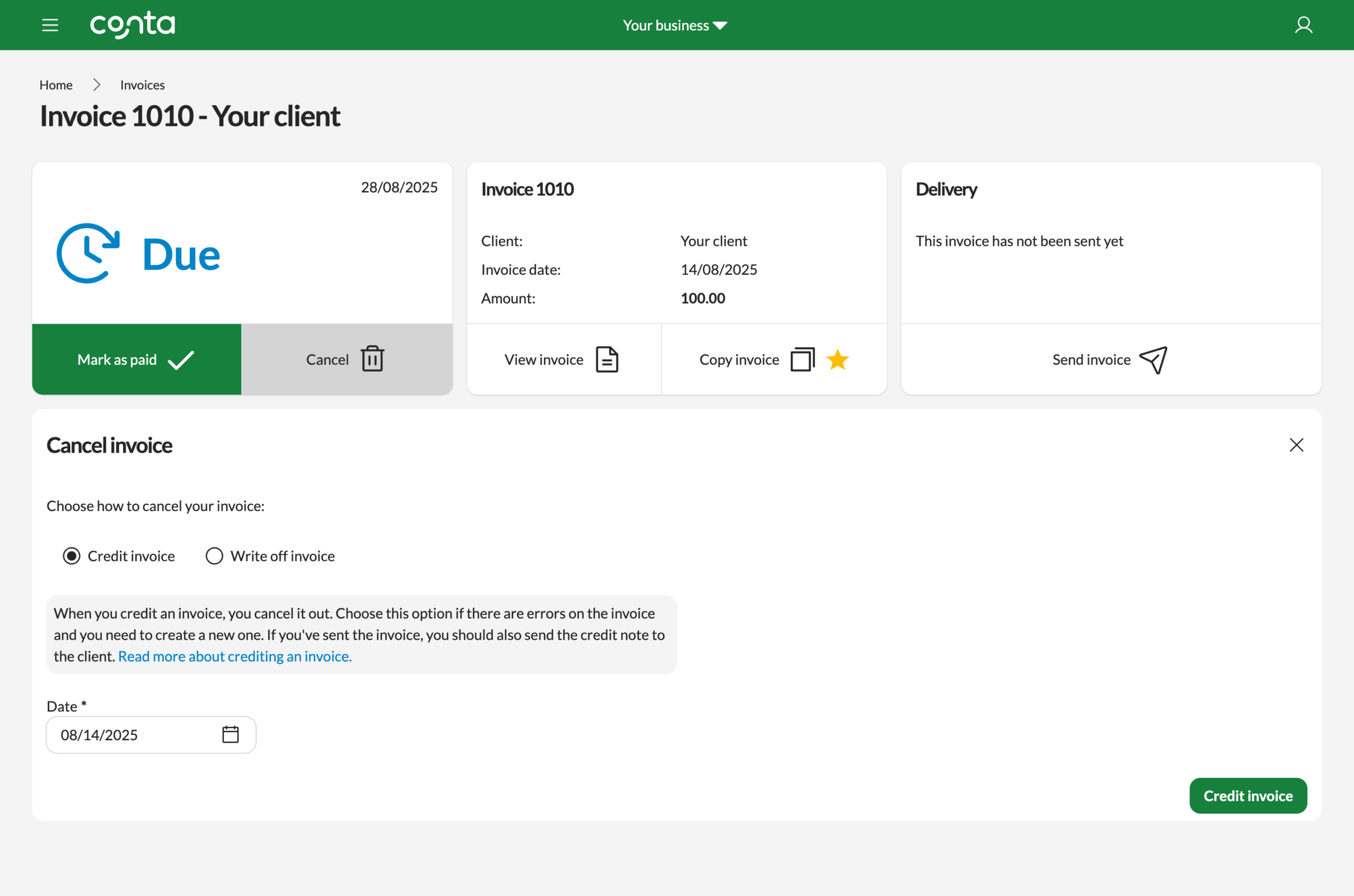

On the homepage, simply click on the invoice under the Follow up or Unpaid invoices-section or search for it in your invoice overview.

Click CANCEL.

The credit note date will default to today’s date, but you can change this if you want.

Then click CREDIT INVOICE.

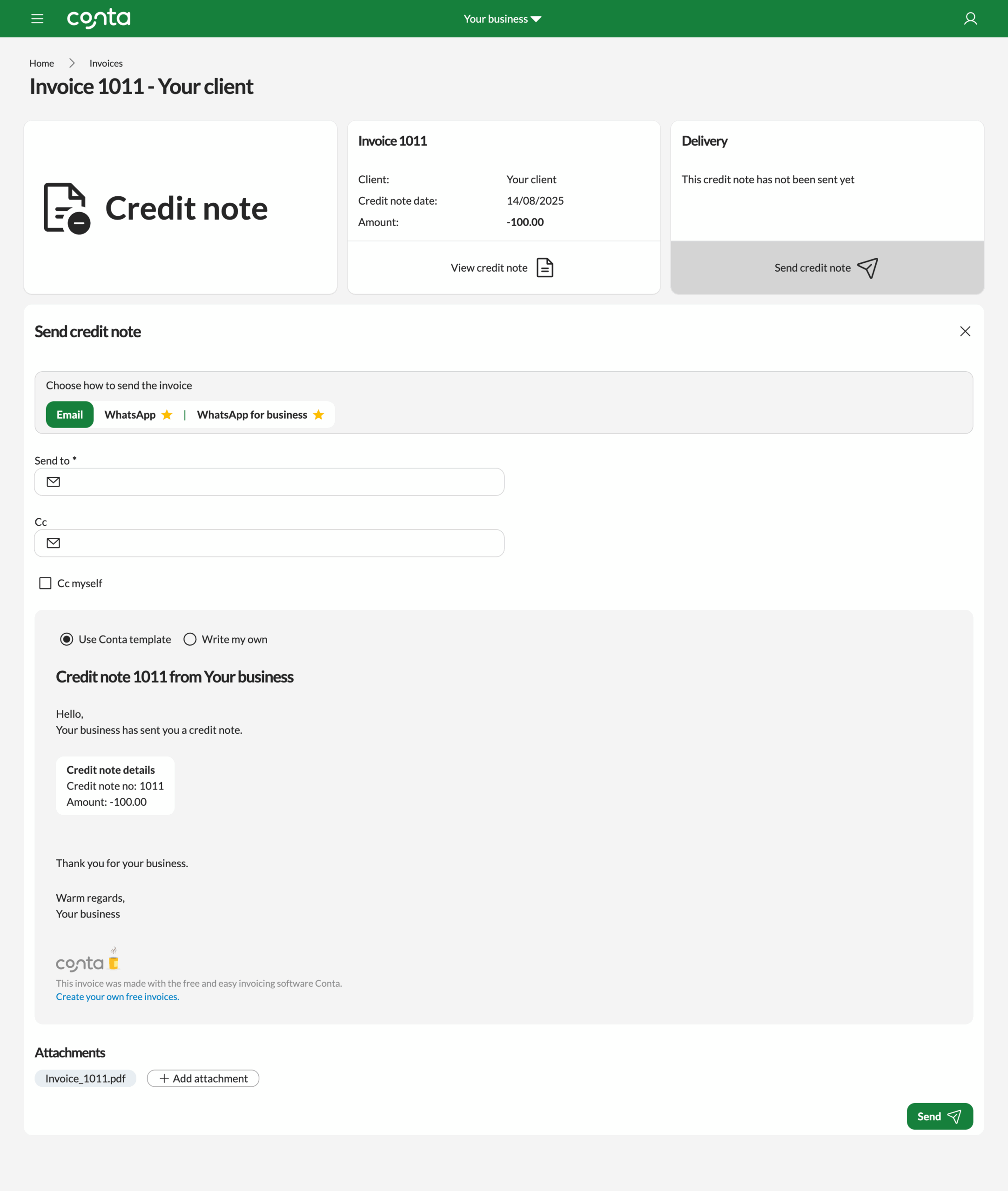

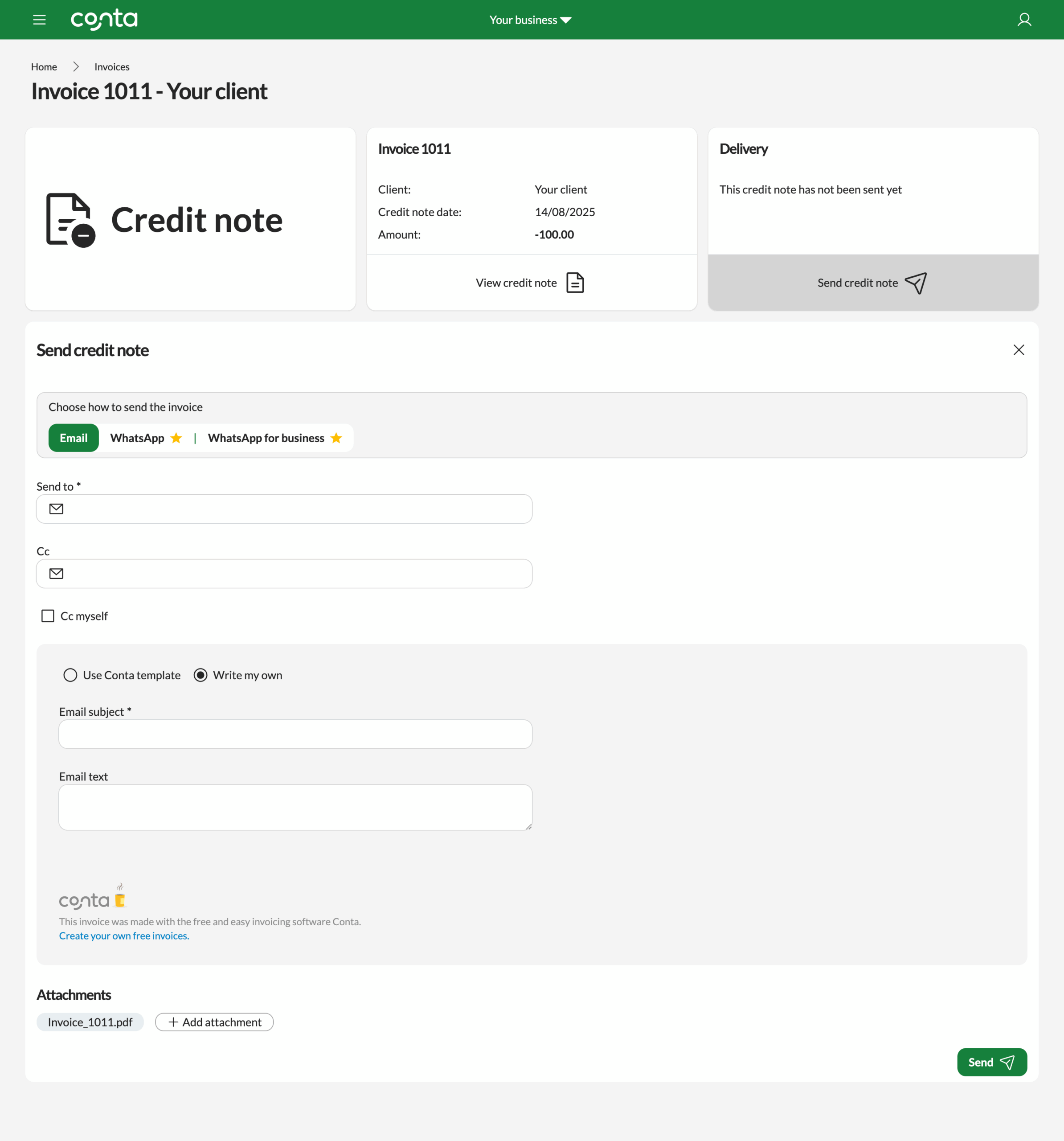

Once the credit note has been created, you’ll see the credit note view with the send tab open. If you sent the invoice to the client, you should send the credit note as well.

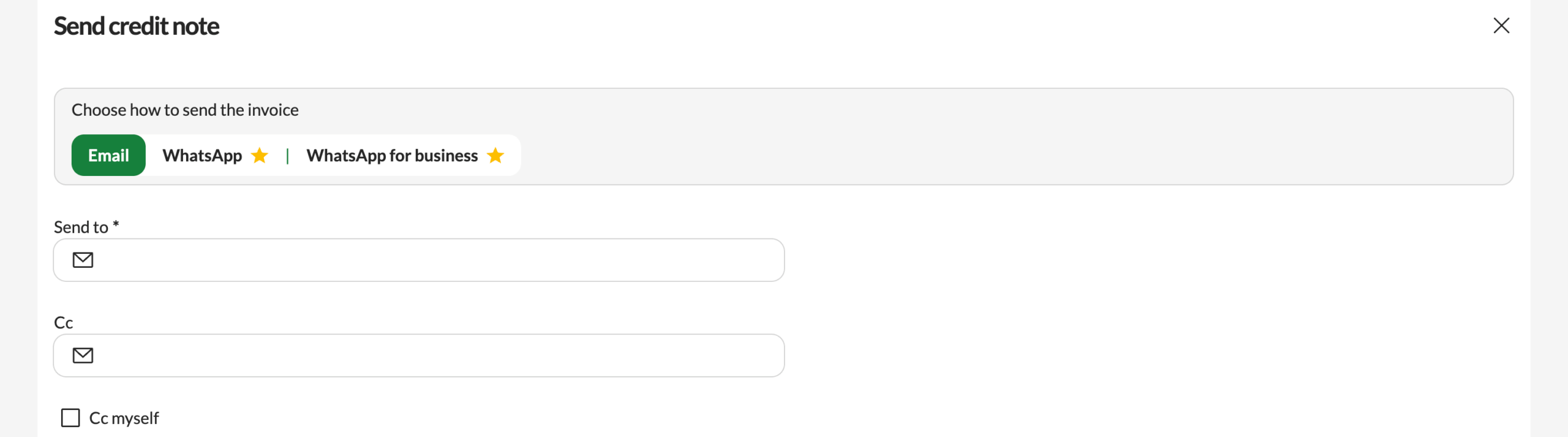

Add a recipient in the Send to-field. You can add additional recipients in the Cc-field. Tick Cc-myself if you want to receive a copy of the email. The copy will be sent to the email address you used to create your Conta account.

Use the Conta email template

When it comes to the content of the email, you can use the Conta template that you see on the screen:

Credit note 1011 from Your business

Hello,

Your business has sent you credit note.

Credit note details

- Credit note no: 1011

- Amount -100.00

Thank you for your business.

Warm regards,

Your business

If you’re using the Conta template, simply click SEND.

Write your own email

You can also write your own email. If you choose this option, you have to enter an email subject line. You should also add email text to provide your client with more information:

Once you’re done writing the email, simply click SEND.

What if I never sent the invoice?

If you never sent the invoice to the client—for example, if you noticed an error right after you created it— you still need to create a credit note for your own bookkeeping, but you don’t have to send the credit note to the client.

Crediting the invoice will also remove the invoice from the list of unpaid invoices in Conta, and only show you the invoices you need to follow up on.

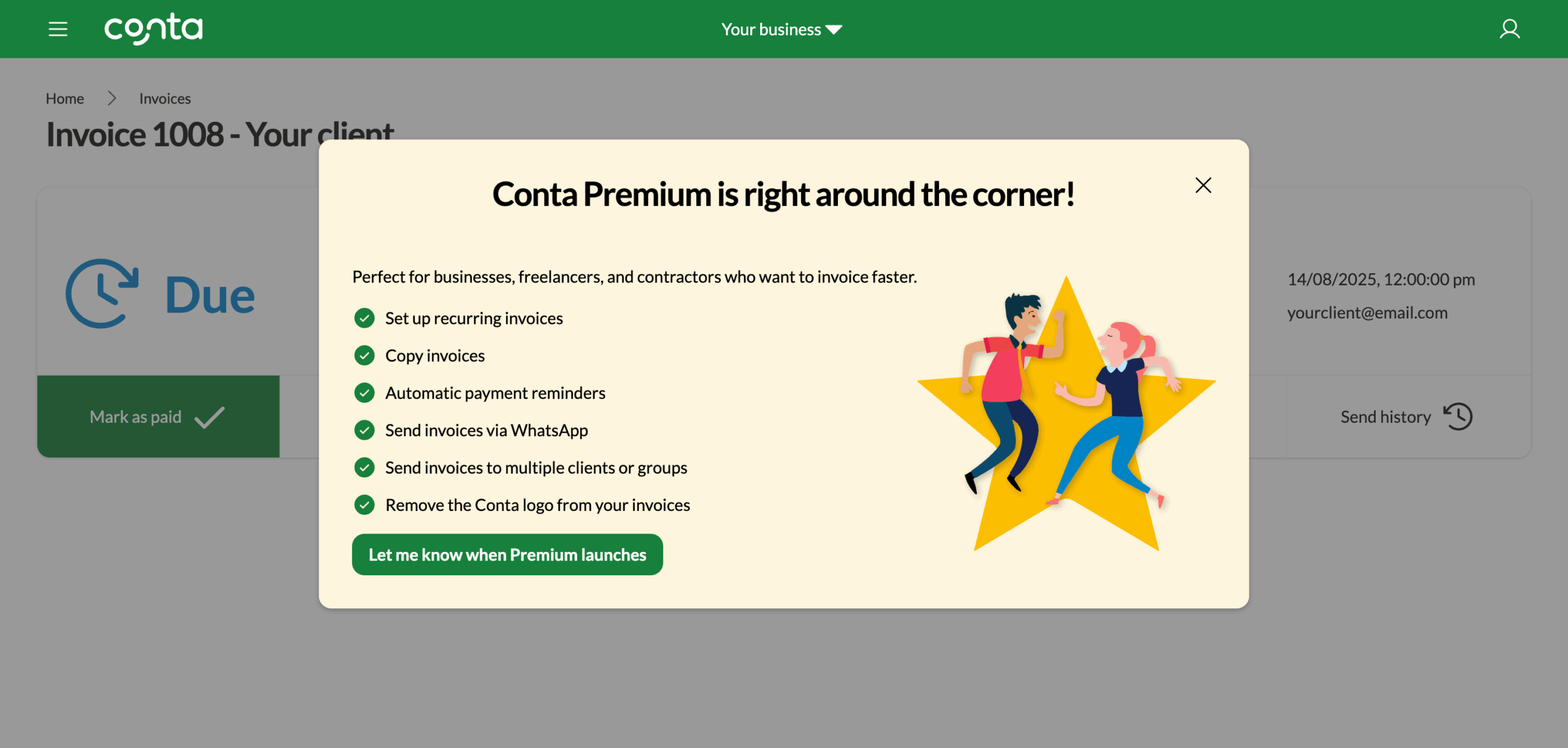

⭐ Coming soon!

In future, you’ll be able to send the credit note via WhatsApp—and even connect a WhatsApp business account. This will make it even easier to fast-track your invoicing. This feature will be part of our premium plan.

Click on a button with a star and click LET ME KNOW WHEN PREMIUM LAUNCHES to stay in the know.

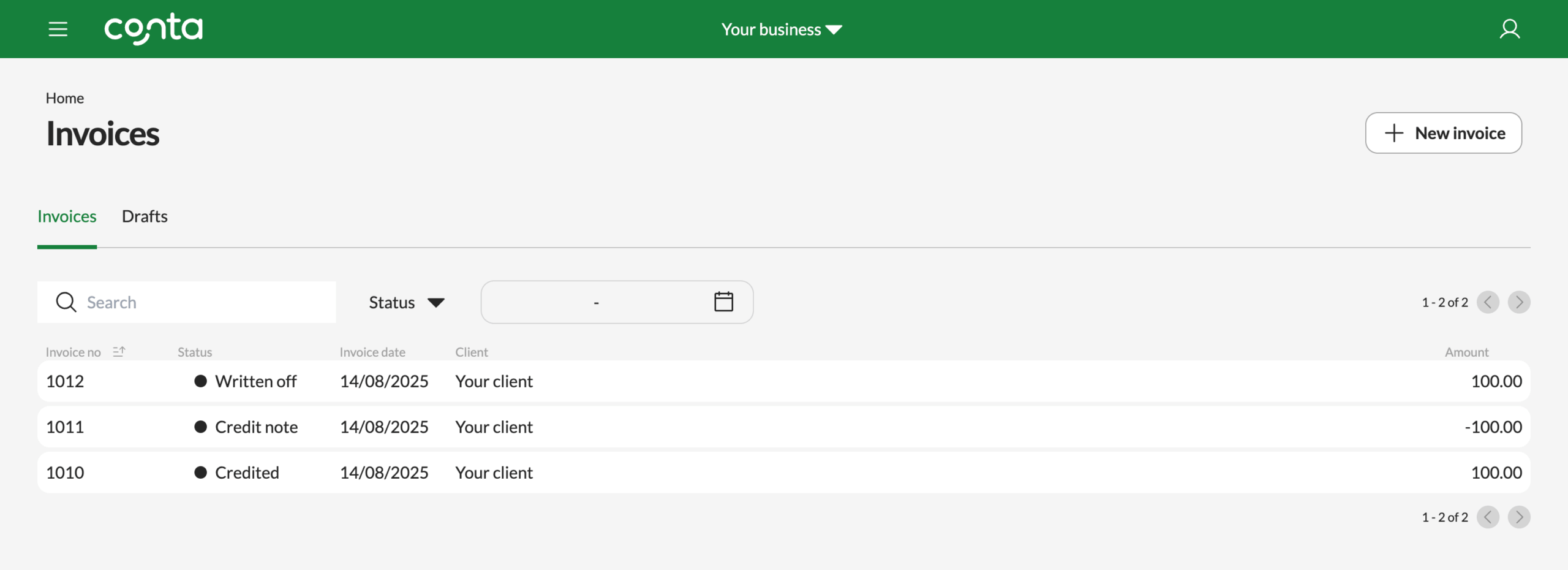

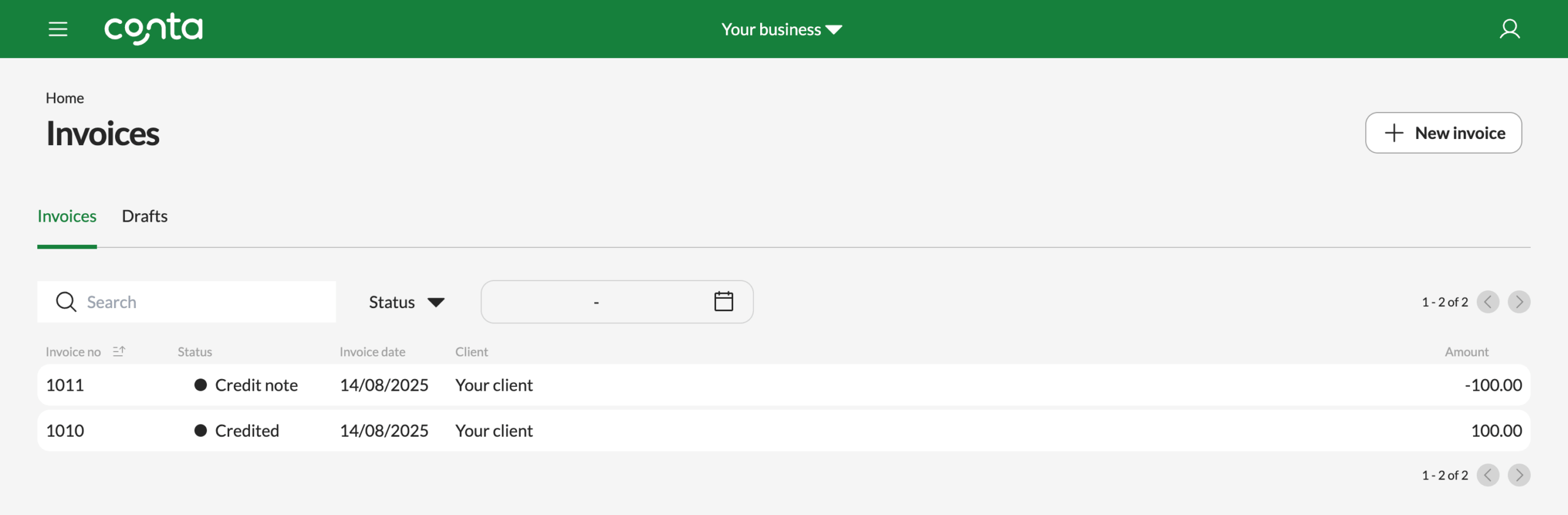

View and manage your credit notes

The invoice will be listed as credited, and you will find the credit note in your invoice overview too:

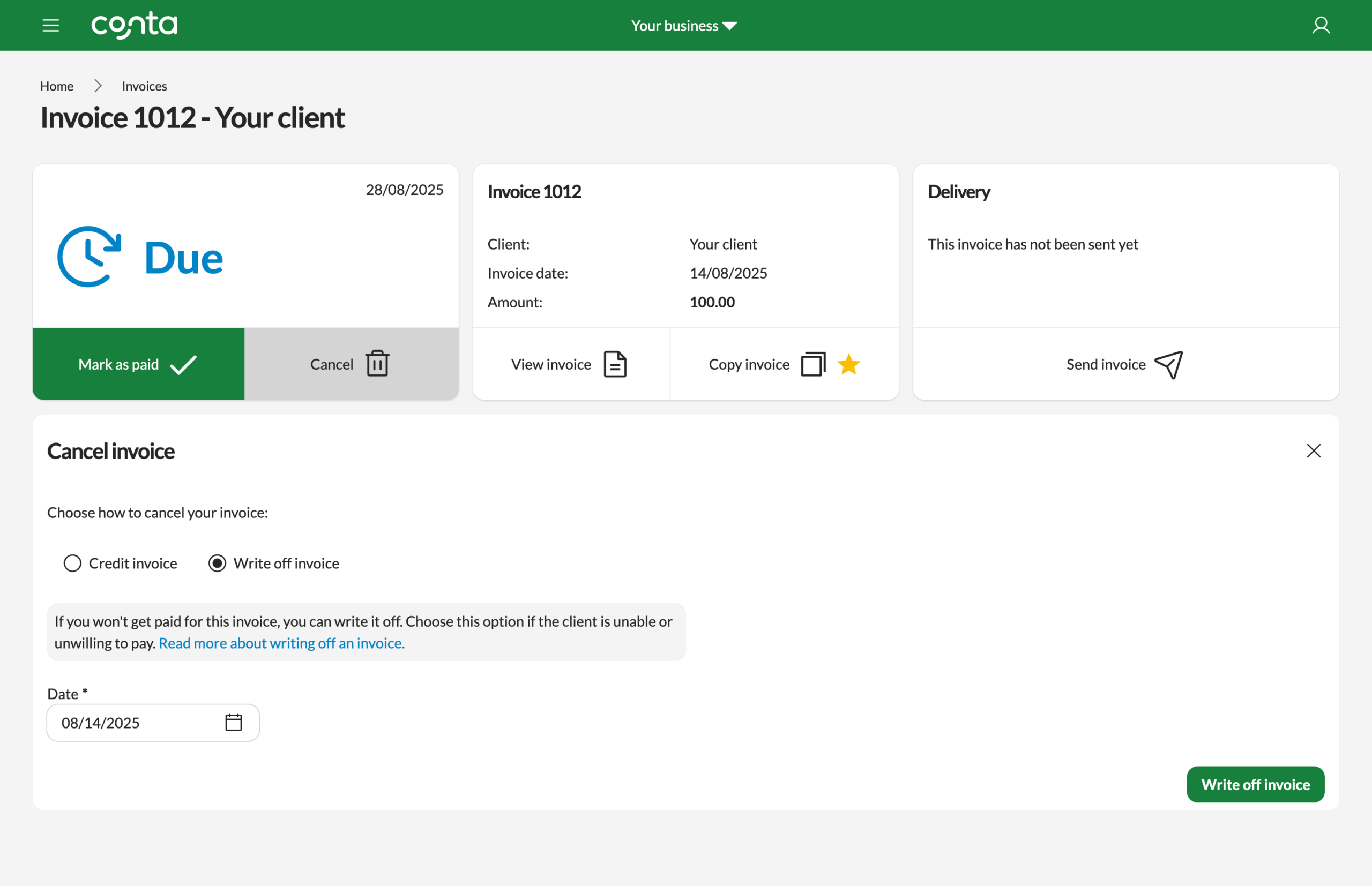

How to write off an invoice

On the homepage, simply click on the invoice under the Follow up or Unpaid invoices-section or search for it in your invoice overview.

Click CANCEL.

The write off-date will default to today’s date, but you can change this if you want.

Then click WRITE OFF INVOICE.

View and manage your written off invoices

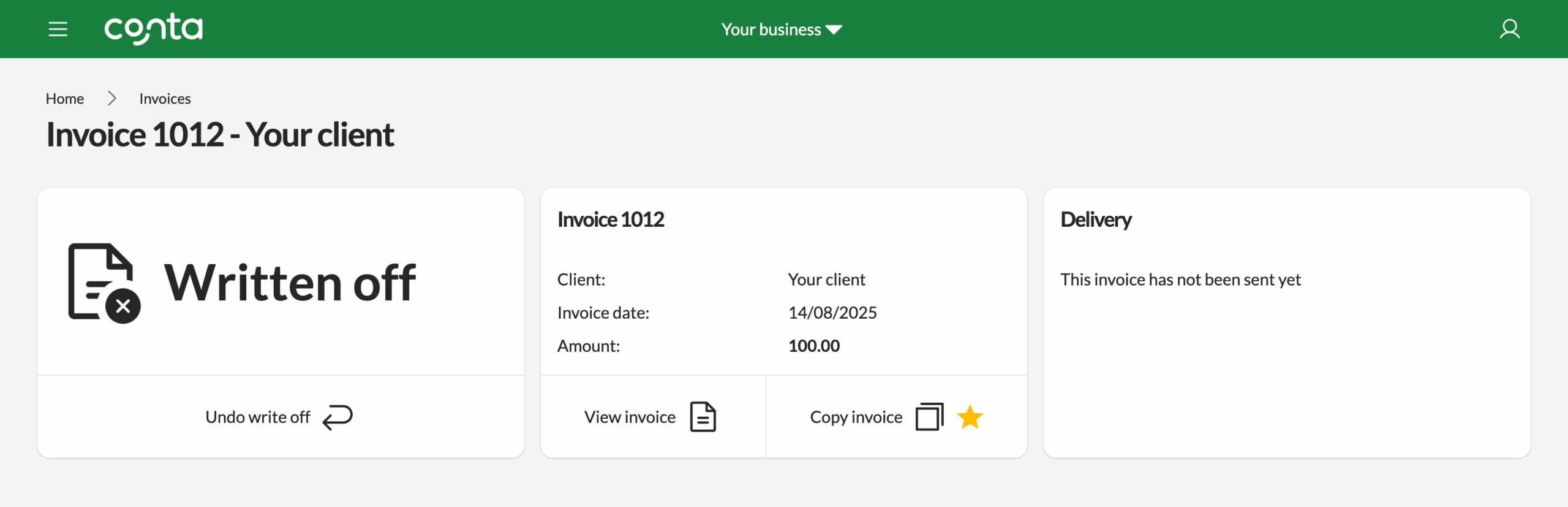

After you’ve written off an invoice, you’ll see the invoice view, where you can undo the write off, view the invoice, and download the written off invoice as a PDF.

The written off invoice will be listed in your invoice overview, but it will be marked as written off rather than due or overdue.