How to add tax on your invoice

With Conta, you can easily invoice with tax. Tax on invoices is called consumption tax. There are different rules for consumption tax in the US and in the rest of the world.

With Conta, you can easily invoice with tax. Tax on invoices is called consumption tax. There are different rules for consumption tax in the US and in the rest of the world.

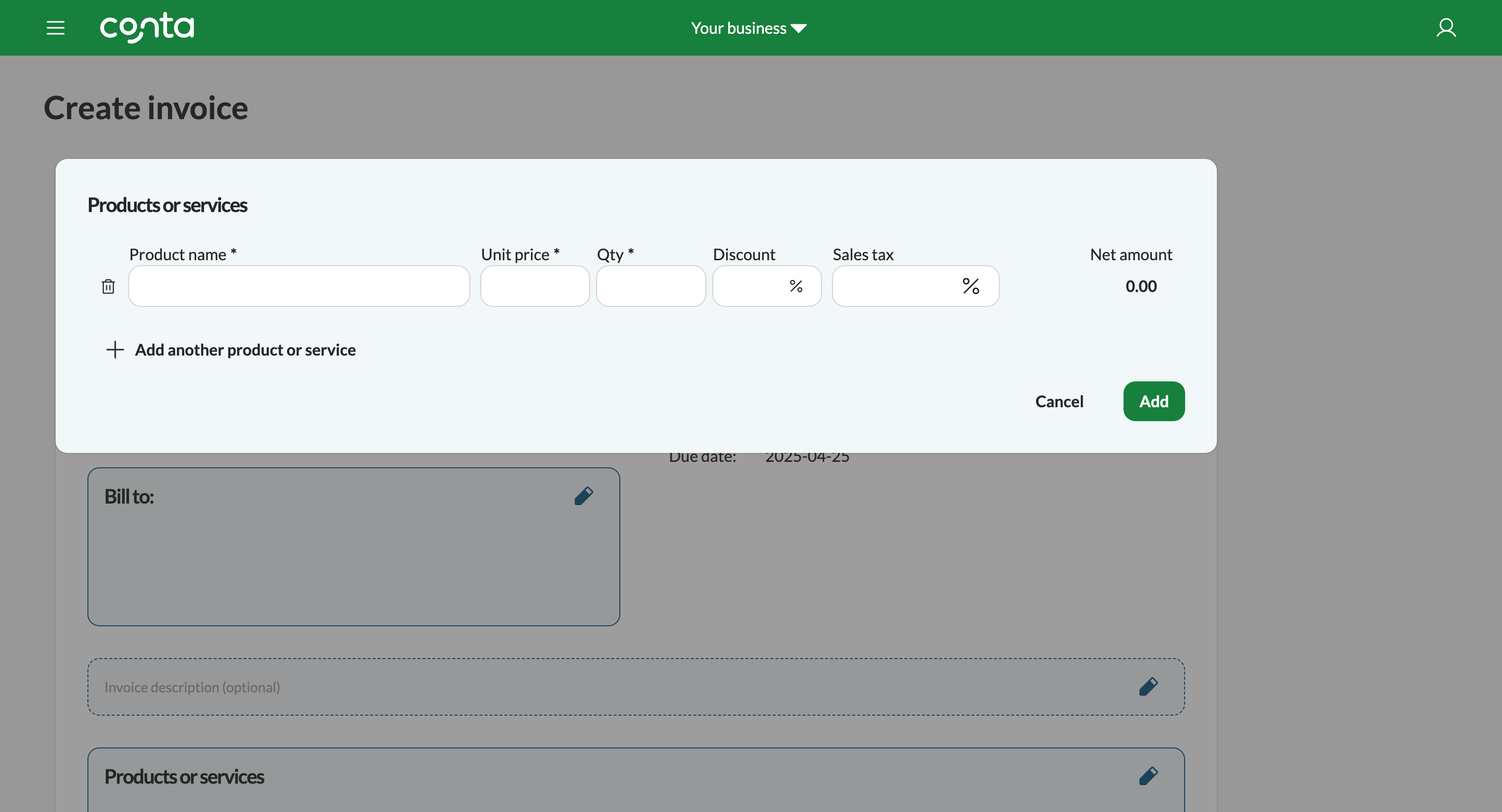

If you’re in the US, you simply enter the sales tax rate when you add the product or service you’ve sold:

If you leave the sales tax blank, no tax will be added to the product.

The sales tax rate varies from state to state, and can also depend on what you’re selling, so you should check what applies in your state, as well as the federal requirements.

The sales tax rate that you add will be saved to the product, but you can always adjust the rate later, either by going to your product catalog and editing the product, or by editing the sales tax rate when you next create an invoice.

Do I have to add tax?

If you’re registered for consumption tax in your country, you should add tax to your invoice.

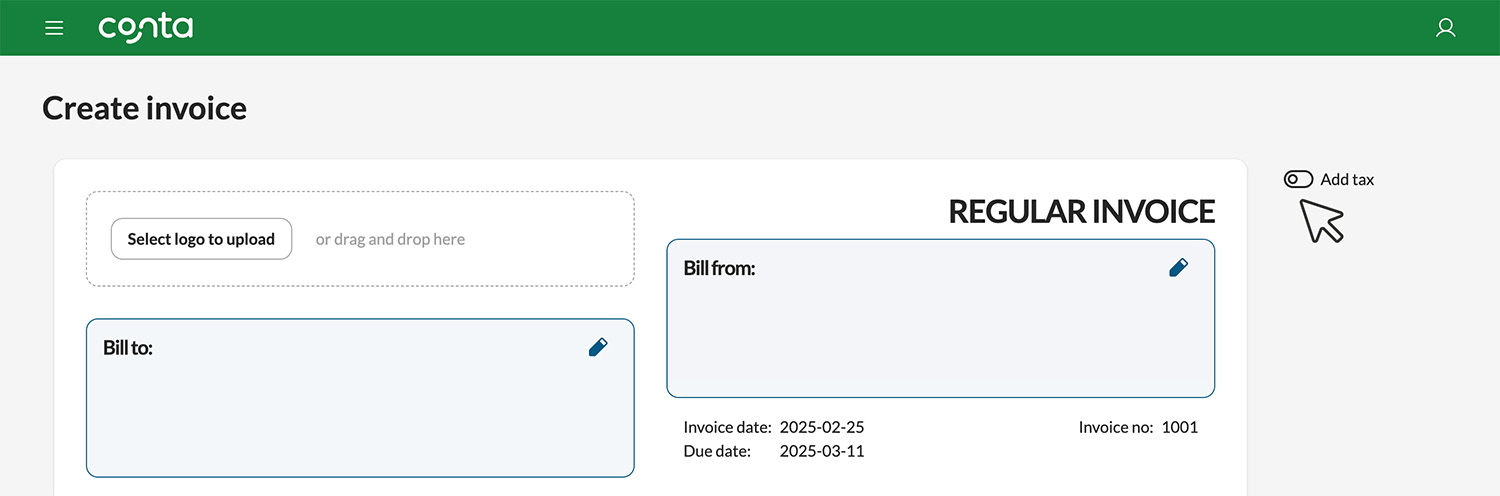

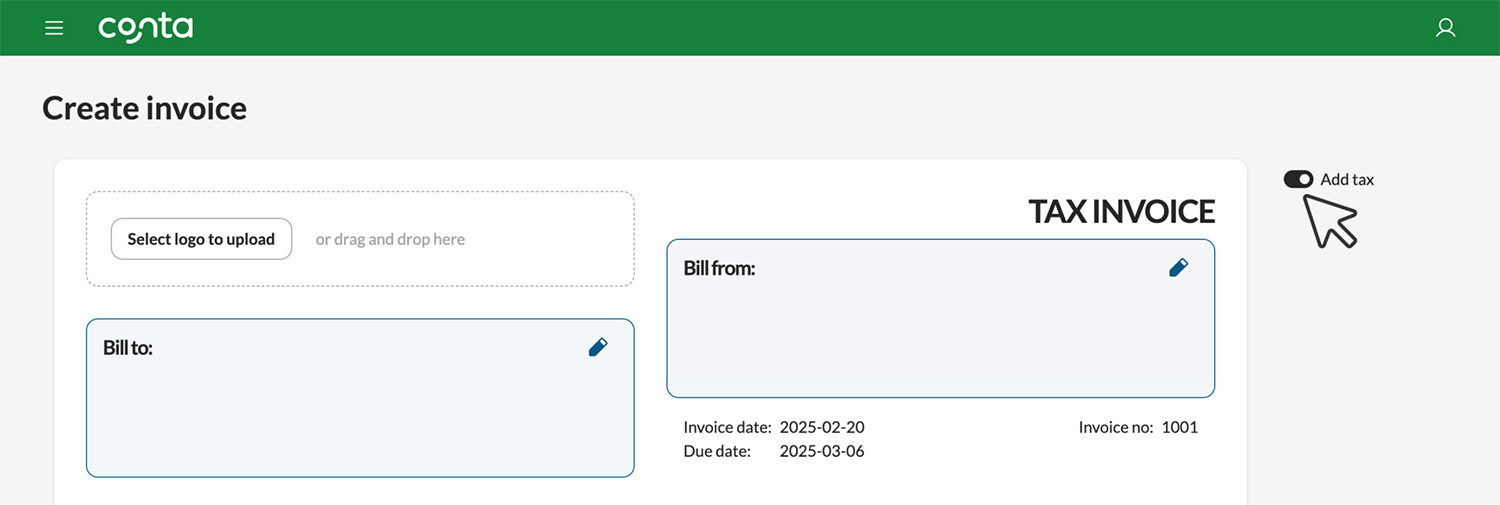

This also means that if you’re not registered for consumption tax, you should turn the tax toggle off:

You’ll then create what’s called a regular invoice, rather than a tax invoice.

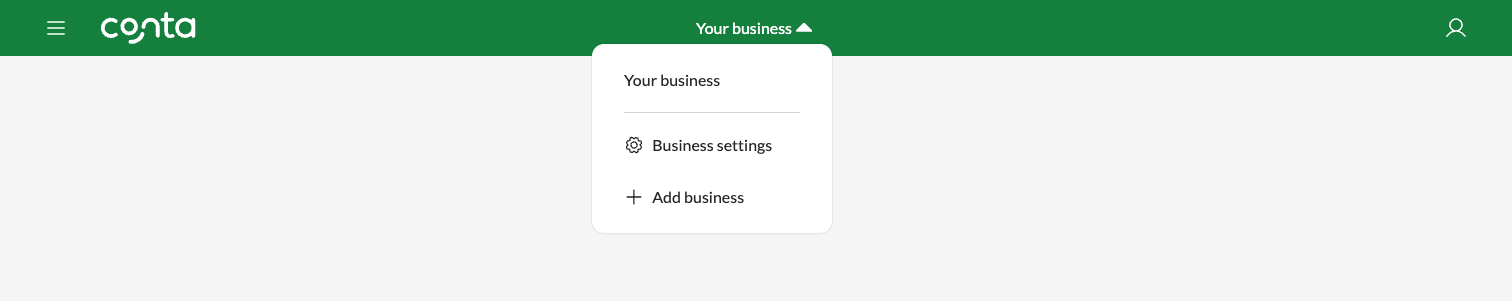

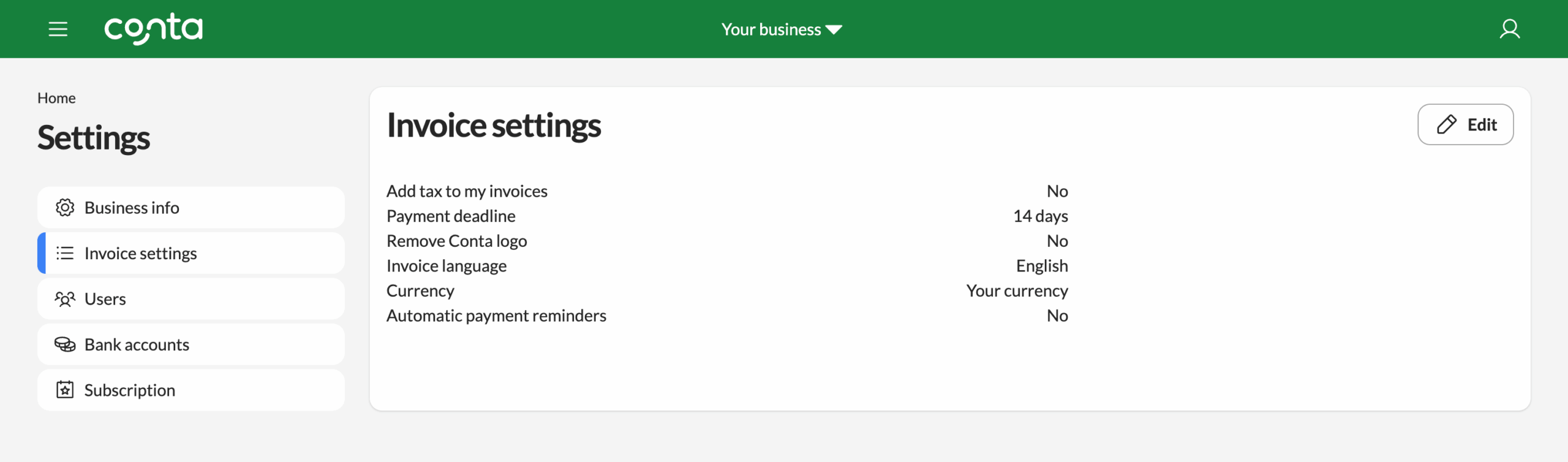

You can permanently turn off the tax toggle by going to your business settings:

Then Invoice settings. If you click EDIT, you can select No on the question Add tax to my invoices.

Whether or not you need to register for consumption tax, depends on how much you’re earning, and sometimes on what industry you’re operating in. The threshold and the requirements vary from country to country, so you should check what applies to you.

I’m registered for consumption tax—now what?

Once you’re registered for consumption tax, you should invoice with tax.

To add tax, you have to first make sure that add tax is toggled:

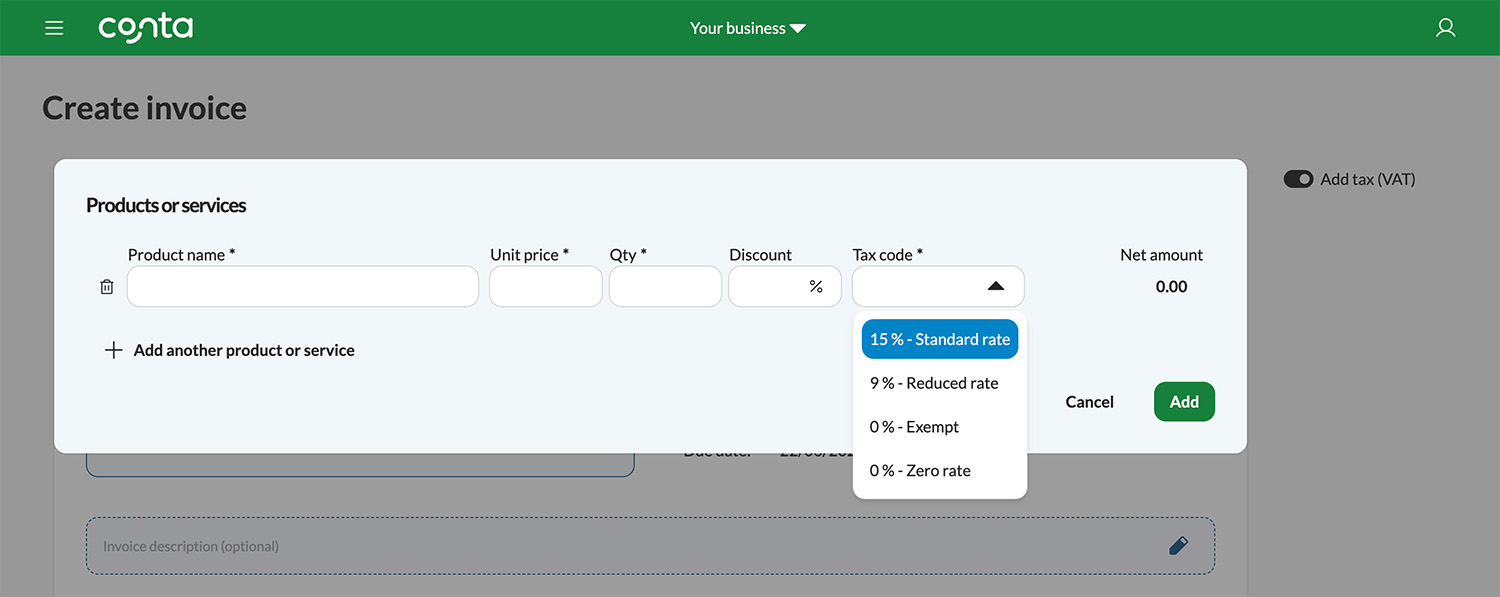

When you go to add your products and services, you’ll be prompted to enter a tax rate per product and service:

The rates you’ll see displayed in the dropdown depend on what country you’re operating in.

How much tax should I add?

Which tax rate you should use depends on what you’re selling. In some countries most products and services have the same rate, in others the rate varies from product to product. Some items are even exempt from consumption tax. We recommend reaching out to a tax specialist, if you have questions about which tax rates to use.

Read more about what to do about tax on your invoice.

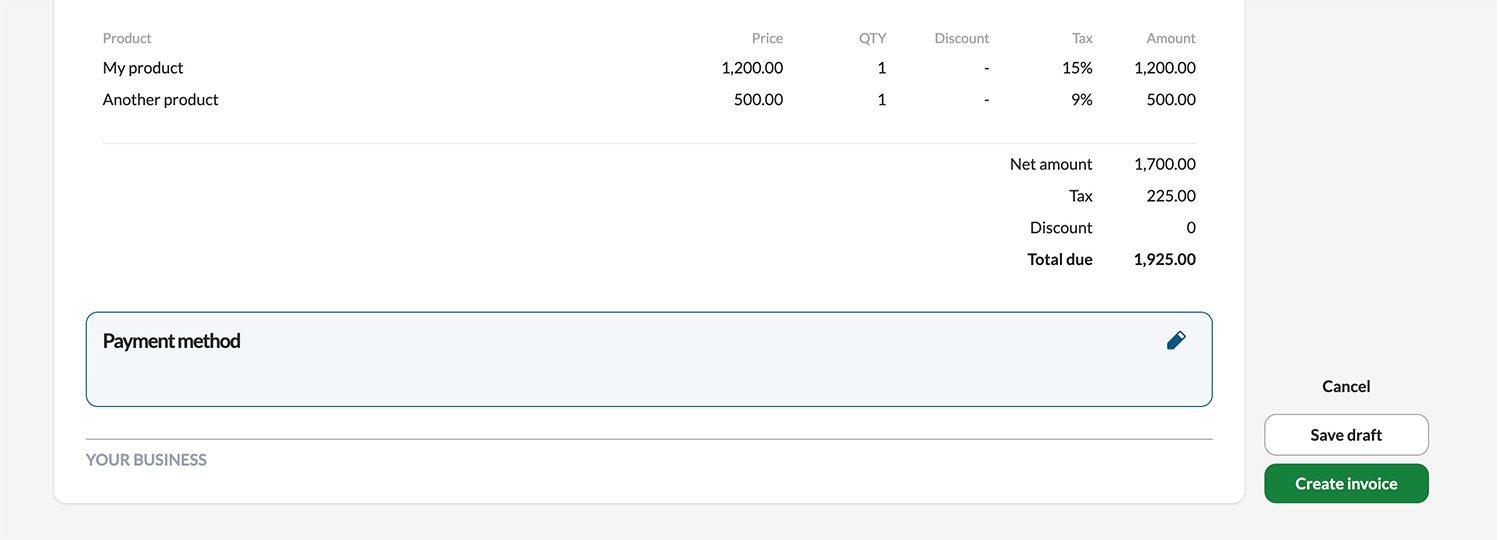

With Conta, you can, of course, choose different tax rates for different products:

The tax and the total amount with tax is worked out automatically. Then simply click CREATE INVOICE to create your tax invoice.